You may have put a lot of time and effort into renovating your property to make it irresistible to a new buyer. But in the rush to conclude the transaction, it is essential to not overlook an important detail: the certificate of location. An up-to-date document helps protect you against potentially costly mistakes.

What does a certificate of location include?

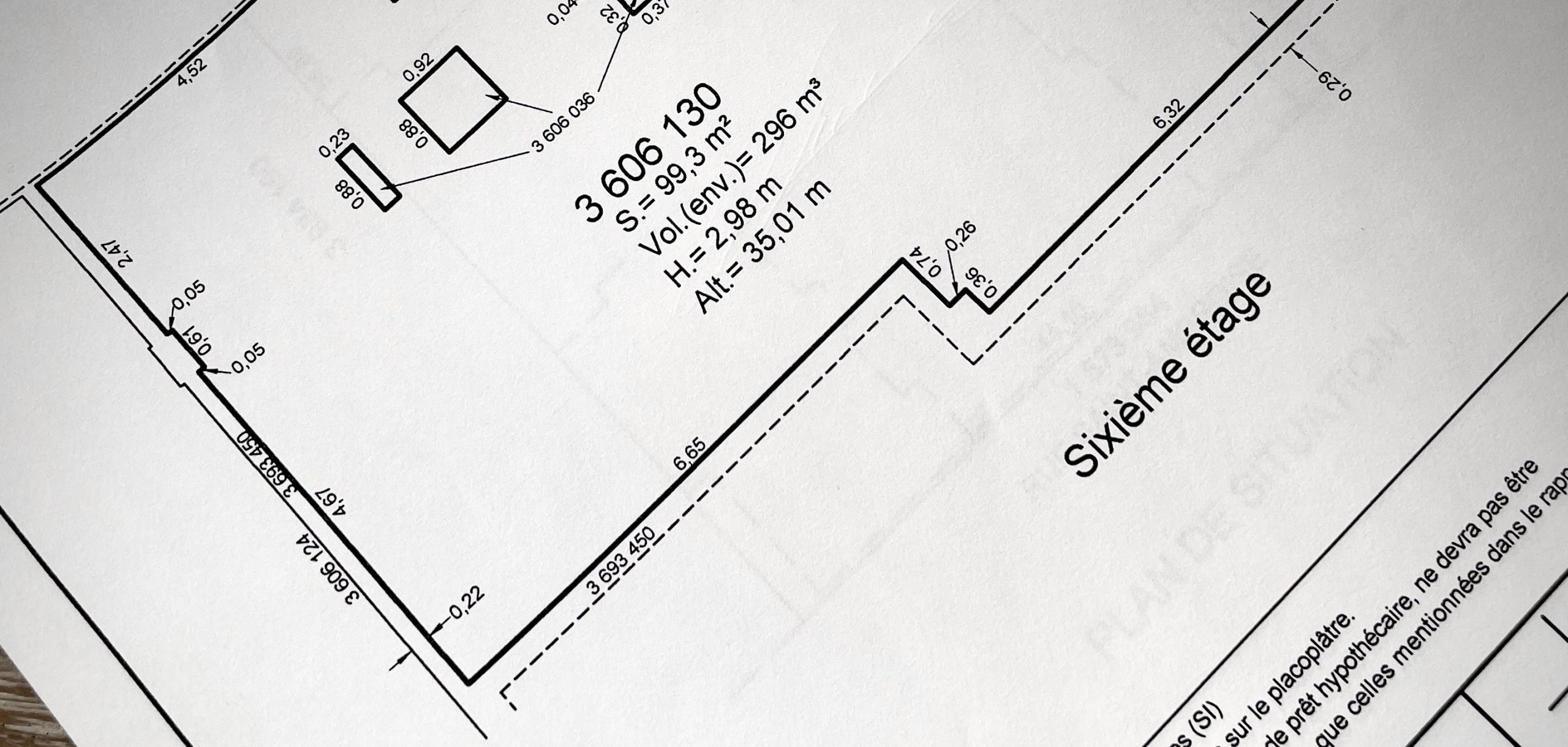

The certificate of location is one of the most important legal documents in any real estate transaction, whether it involves a commercial or residential building, house, duplex or condo. This report, prepared by a land surveyor accredited by the Ordre des arpenteurs-géomètres du Québec, outlines how a property is situated and its current state, which includes any titles, lots, zoning regulations and municipal bylaws that may affect it. In the case of a condominium, the certificate will cover the unit only and not the entire building. If no changes are made to the property, a certificate of location is valid for 10 years.

How it affects the promise to purchase

“You should commission a certificate of location as soon as you know you want to sell your property,” advises Katia Samson, founder of the Katia Samson Real Estate Group. “But you should wait until exterior renovations, such as an extension or adding a terrace or balcony, have been completed. That way, if there are any surprises—for instance, if you made an improvement that encroaches on a neighbouring property—there is enough time to correct the issue.”

Samson, a broker with more than 25 years of experience concentrating on the Griffintown and Sud-Ouest areas of Montreal, often sees cases where a promise to purchase must be notarized within 30 days. If the certificate of location is not current, you may have to pay additional costs to have the document produced more quickly.

And should, as in the above case, the certificate of location show the presence of easements or encroachment on a neighbouring property, signing the deed of sale should be delayed until the property title describes precisely what is included in the sale. And the buyer might opt to back out of the contract.

In the event of any irregularities, the seller must purchase title insurance. The cost may vary between over $1,000 for a small transaction to several thousand dollars for a large one.

“These situations potentially can add significant costs to a transaction but may be avoided by obtaining the certificate of location well in advance,” Samson says. “All the more reason to make sure your certificate is up to date before placing that ‘for sale’ sign on your property.”